Table of Content

SURF offers an option where the repayment schedule is linked to the expected growth in your income. You can avail a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in your income. Check your loan eligibility before starting your home loan application. There are many advantages to applying for an HDFC home loan.

If you are working abroad, your income will need to be in the range of Rs. 50,000-Rs. You will also need to be able to provide a bank statement and salary certificate. If you are working in India, your income will need to be above a certain threshold. Once you decide on the amount, you will need to find out the amount of your salary that is available to borrow. Now that you know how much you can borrow, you will want to compare the interest rates. If you are thinking to take a home loan, then you should consider this bank.

STANDARD HOME LOAN RATES

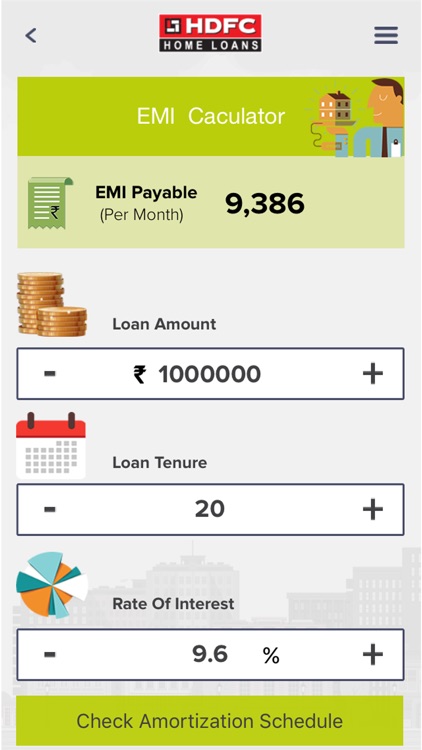

Here is a list of the advantages of taking a home loan from HDFC bank. Home Loan is getting more popular day by day because it is a very convenient way to buy a home. In this blog post, I will tell you about the benefits and disadvantages of HDFC Home loan. The EMI Calculator computes the outcome using amount, tenure, and the applicable interest rate. Select the type of intended home loan in the “Basic Information” tab.

It is already understood that HDFC Bank offers a range of home loan products for every preference and need. In other words, HDFC Bank provides Personalized Home Loan solutions. Apart from purchase and construction, a home loan for renovation, extension, balance transfer, and top-up match competitive terms. As such, either the EMIs will be increased or decreased, or the loan repayment may get extended. In some situations, there may be a change in both EMIs and the loan tenure.

What would be my monthly repayment

Obtain your credit report periodically, say once or twice in a year, verify the same for errors and get them rectified as and when required. To be eligible for Home Loan, you first need to be a permanent resident of India. However, you also need to be either a permanent resident of India or a person who has been living in India for 3 years. First of all, you will want to decide on the amount you want to borrow.

Passport size photograph of all the applicants / co-applicants to be affixed on the Application form and signed across. Ensure that the documentation of your home loan application is in order as per the requirement of the lender. It can take years to accumulate sufficient funds for buying a house. You can simply take a home loan to purchase your dream house.

How does a home loan work in India?

HDFC Bank is among the earliest Private Sector Banks operating since 1994. HDFC Bank’s home loan portfolio boasts Home Loans, Home Improvement Loans, Home Extension Loans, Plot Loans, Balance Transfers, and Top-up Loans. It does not matter if you are salaried or self-employed, a resident or an NRI. Suitable HDFC Bank home loans are tailored to every need of the customer.

Check with the lender if the property that you have shortlisted will be considered for a housing loan. Improve your credit score by creating a reasonable track record of timely repayments so that you achieve a high credit score which would improve your prospects of getting a home loan. You can download account statements, interest certificates, request for home loan disbursement and do much more. Our chat service on our website and WhatsApp are available 24X7 to assist you with your housing loan related queries.

If a higher loan amount is taken, it has a higher rate of interest. The rate of interest is subject to revision from time to time. These revisions are due to changes in Base Rate or change in the lender policies. Under the latter condition, the interest rates can be revised by SBI.

Opt for a home loan provider who offers longer tenure loans, flexible repayment options etc. Interest rates may differ depending upon the loan amount, profession (salaried or self- employed) and your credit score among other factors. In an adjustable or floating rate loan, the interest rate on your loan is linked to your lender’s benchmark rate. Any movement in the benchmark rate will effectuate a proportionate change in your applicable interest rate.

However, the approval of your loan depends on your repayment capacity. It is up to HDFC to assess your eligibility and ability to repay the EMIs for two home loans. You can apply for a home loan online from the ease and comfort of your home with HDFC’s online application feature. Alternatively, you can share your contact details here for our loan experts to get in touch with you and take your loan application forward. You may be eligible for tax benefits on repayment of the principal and interest components of your Home Loan as per sections 80C, 24 and 80EEA of the Income Tax Act, 1961. Since the benefits may vary each year, please do consult your chartered accountant/ tax expert for the latest information.

You are going to want to compare the interest rates and decide if the one you choose would be the best for you. You can go to HDFC Bank’s website to compare the interest rates. Once you have decided on a loan, you will need to fill out the application form.

The information provided on our website is for informational purposes only and it should not be considered as financial advice. Please consider your specific investment requirements before choosing any investment or designing a portfolio that suits your needs. HDFC & HDFC Sales are merely acting as a Point of Presence & Point of Presence (sub-entity) respectively for the purpose of the NPS. Check with the lender if the property that you have shortlisted can be funded. Provide all the required legal and technical documents so that the lender can carry out the necessary due diligence. There has been a significant reduction in GST rates on home purchase.

However, the offer is available to ARHL only, linked to the Benchmark Rate applied through the loan tenure. HDFC Loans are available in Adjustable Interest Rate and Tru-fixed Interest Rate. While the former varies according to the external reference rate fluctuation, the latter provides a fixed interest rate for the first two years of the loan tenure. After that, the rate is converted to a floating rate for the remaining loan tenure. Thus, it is a combination of floating and fixed interest rates. The applicants in this category can be both salaried employees and self-employed individuals.

The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in proportion to the income. The prepayment charges are subject to change as per prevailing policies of HDFC and accordingly may vary from time to time which shall be notified on . The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. Up to 0.50% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes. The maximum period of repayment of a loan shall be up to 30 years for the Telescopic Repayment Option under the Adjustable Rate Home Loan.

No comments:

Post a Comment